Other types of government debt securities and financial instruments such as equities are still not allowed to be sold short in the. A bond is a debt security kind of like an official IOU issued by governments or companies who want to raise money.

Krazy Glue Features Formulas To Fit Every Type Of Craft And Fix And Bonds To Every Material Including Glass Leather And Plastic Glue Crafts Super Glue Crafts

Islamic religious law known as Sharia guides the creation of sukuks which are financial certificates that are similar to.

. Currently the various forms of Government securities in Malaysia are. Method of Issuance. Retail investor individual angel investor individual and businesses.

However as an investor the type of investment product you choose to invest in is usually determined by several common factors such as investment goals risk appetite and risk tolerance investment time frame and available cash to name a few. ETBS are issued either by companies or governments the issuer to raise funds for their needs. These products can cater to the needs of various types of investors such as retail sophisticated young senior.

When you buy a bond youre lending money to the issuer. Malaysias bond market is predominantly offered to and traded by sophisticated investors. The bond is therefore said to be at 102.

Domestic and foreign investors can buy and sell conventional and Islamic debt instruments through the exchange and over-the-counter OTC. Products range from simple and basic bank deposits to more complex structured finance instruments. The Sukuk is a special type of bond.

Coupon is at RM102. The Securities Commission Malaysia SC was established on 1 March 1993 under the Securities Commission Act 1993 SCA. Generally divided into 3 categories.

In Malaysia corporate bonds are predominantly issued to sophisticated investors. We are a self-funded statutory body entrusted with the responsibility to regulate and. Bank Negara Malaysia BNM also issues rulings for approvals for certain types of bonds including non-tradable and non-transferable bonds issued to non-residents.

They are a way to raise money for projects and investment and are also known as credit. A corporate bond is an IOU issued by a company corporation rather than a government typically with a maturity of greater than one year. There are 2 possible ways to buy bonds in Malaysia.

Considered a high-risk investment kind of all-or-nothing may lose all investment money. Investment products in the capital market securities include shares unit trusts warrants bonds and private retirement schemes. What are the Islamic bonds available in Malaysia.

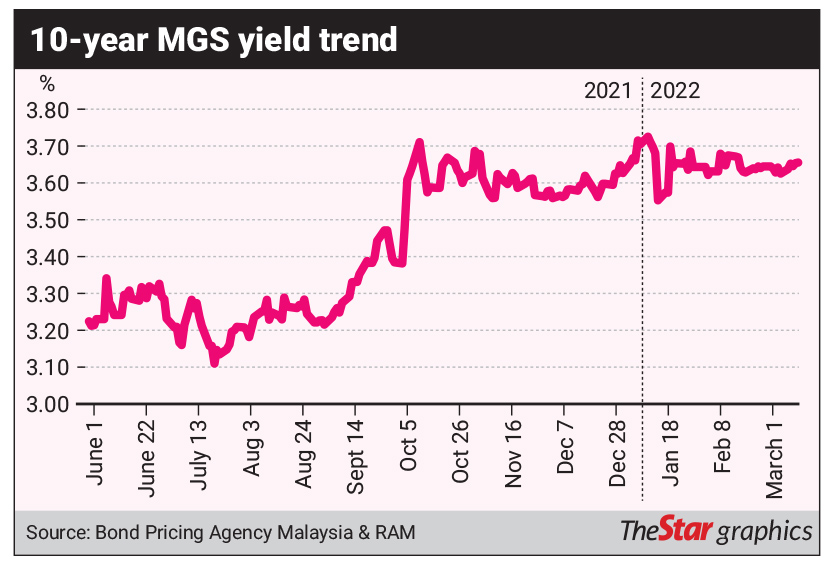

Malaysian Government Securities MGS - long-term interest-bearing debt securities. The above computation of yield is true if the bond had a 1 year tenure. ETBS are fixed income securities also known as bonds or sukuk that are listed and traded on the stock market.

How to Buy Bonds in Malaysia. In return the issuer promises to pay a predetermined interest rate at specific intervals eg. Anything less than that is often referred to as commercial paper 3.

Bank Negara Malaysia BNM also issues rulings for approvals for certain types of bonds including non-tradable and non-transferable bonds issued to non-residents. The Malaysian capital market offers various investment products in the form of shares unit trusts bonds warrants and derivatives. Youll be taxed if you gain profit from renting a house land vehicle or even goods used by someone where you receive money in return.

Provides comprehensive Malaysias bonds market information and analysis yield curve for Malaysian Goverment Bond Malaysian Government Securities MGS Islamic Bond Cagamas Khazanah Bond and Corporate Bond. The Islamic bond market in Malaysia has seen outstanding growth and has established itself as a viable alternative investment for both Islamic and conventional investors. However corporate bonds of certain eligible issuers may be issued to retail investors and in this.

Click this LINK to find the most active bonds in the market and choose according to your risk appetite from the various types of bonds such as government bonds quasi government bonds corporate bonds and Islamic bonds. Top 5 Bonds in Malaysia. Comparison between Conventional and Islamic Concept.

ETBS have varying structures such as. The central bank Bank Negara Malaysia acts as banker and adviser to the Government and assists in planning and facilitating issuances through market infrastructure that it owns and operates. 15 June 2015 Revised.

The issue of a bond will often provide low. Guidelines on Issuance of Corporate Bonds and Sukuk to Retail Investors pdf Date Issued. Provides comprehensive Malaysias bonds market information and analysis yield curve for Malaysian Goverment Bond Malaysian Government Securities MGS Islamic Bond Cagamas Khazanah Bond and Corporate Bond.

Let us now calculate the yield on this bond. Investors such as you will then lend these companies money by purchasing the issued bonds and after a certain period the company will pay back the amount borrowed. The Malaysia credit rating is A- according to Standard Poors agency.

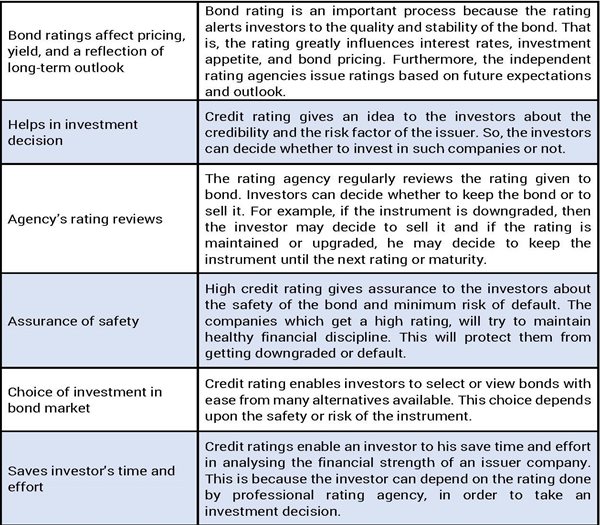

In Malaysia bonds issued by corporates will be rated by rating agencies such as RAM and MARC. Normal Convexity in Long-Term vs Short-Term Maturities. Charts and data non the outstanding amount of the various Islamic bonds in Malaysia is attached in Appendix I.

The market offers a wide range of instruments considering the fact it has the largest Sukuk market in the world. Yield on bond RM5 RM102 x 100 490. Even though the corporates already be rated by the rating agency the bond that they issued could differ from the rating the corporates have.

Annual coupon on the bond 5 x RM100 RM5. Assume the market value of a RM100 bond with 5 pa. A bond is a certificate or security showing that the investor has loaned funds to a company or to a government in return for fixed future interest income and repayment of principal.

In Malaysia corporate bonds are predominantly issued to sophisticated investors. Might be philanthropic as they only invest in businesses that they believe in and reflects their values. Current 5-Years Credit Default Swap quotation is 5719 and implied probability.

The Securities Commission SC regulates the issue and offer of corporate bonds and sukuk in Malaysia. The Malaysia 10Y Government Bond has a 4202 yield. 8 November 2017.

Provides comprehensive Malaysias bonds market information and analysis yield curve for Malaysian Goverment Bond Malaysian Government Securities MGS Islamic Bond Cagamas Khazanah Bond and Corporate Bond. The Malaysian capital market offers various investment products in the form of shares unit trusts bonds warrants and derivatives. There are three types of bond covenants - positive covenants negative covenants and financial covenants.

These are payments made to an individual or company for the ongoing use of. However as an investor the type of investment product you choose to invest in is usually determined by several common factors such as investment goals risk appetite and risk tolerance investment time frame and. 10 Years vs 2 Years bond spread is 904 bp.

Central Bank Rate is 200 last modification in May 2022.

The Malaysian Bond Market Bank Negara Malaysia

Bonds Are Like The Arrangement Or Bricks To Strong The Imaginable Interlocking And Stop The Flow Of The Vertical Joints That Can Be Brick Masonry Brick Masonry

Olaplex No 5 Bond Maintenance Conditioner 250ml In 2022 Paraben Free Products Shampoo Olaplex

High Demand Seen For Bonds The Star

Fundsupermart Com Invest Globally And Profitably Malaysia Mutual Funds Unit Trusts Invest Fund Supermarket Investing Mutuals Funds Investment Companies

Olaplex Repair Protect Strengthen Hair Olaplex Olaplex Treatment Paraben Free Products

High Bond Yields In Play The Star

The Malaysian Bond Market Bank Negara Malaysia

Malaysia Https De Pinterest Com Correodediego Passports Passaporte Cartao De Credito

Short Sleeve Baby Rompers Animal Dinosaur Print Baby Boy Clothes Jumpsuit Summer Onesie Infant Baby Girls Newborn Clothings In 2022 Rompers For Kids Kids Sleepwear Short Sleeve Romper

Lantern Hotel Zlgdesign Arquitectura De Ladrillo Diseno De Ladrillo Fachadas Casas Minimalistas

Napkins Napkin Finance Economics Lessons Accounting Basics Finance

Why Is Credit Rating Important For Bond And Sukuk Bix

The Bond By Sabek In Muar Malaysia Urban Wall Art Street Art Street Artists

/dotdash_Final_How_Are_Bonds_Rated_Sep_2020-01-b7e5fc745626478bbb0eed1fb5016cac.jpg)